Investment Outlook for Semiconductor and Energy Stocks

Main Keyword: Semiconductor and Energy Stock Investment Outlook

- Semiconductor and energy stocks are expected to outperform in the current market environment.

- The semiconductor industry is poised for growth due to increasing demand for tech products.

- Renewable energy sources are gaining traction, making energy stocks an attractive investment option.

- Investors should consider diversifying their portfolio with semiconductor and energy stocks for better returns.

- It is crucial to conduct thorough research and monitoring of market trends before making investment decisions.

Investment Outlook for Semiconductor and Energy Related Stocks:

The outlook for semiconductor stocks remains positive due to increasing demand for semiconductors in various industries such as technology, automotive, and healthcare. Stocks of companies involved in semiconductor manufacturing, design, and equipment are expected to perform well in the coming months. Investors may consider companies with strong fundamentals and a focus on cutting-edge technology.

On the other hand, energy related stocks are also attracting attention from investors. The transition towards renewable energy sources and the increasing adoption of green technologies are driving growth in the energy sector. Companies involved in renewable energy production, electric vehicles, and energy storage are likely to see strong performance in the future.

Summary:

- The semiconductor sector is poised for growth with increasing demand in various industries.

- Investors should consider companies with strong fundamentals and cutting-edge technology in the semiconductor industry.

- The energy sector is also promising, especially with the shift towards renewable energy sources.

- Companies involved in renewable energy production, electric vehicles, and energy storage are expected to perform well.

Investment Strategy for Semiconductor, Solar, and Secondary Battery Related Stocks

Main keyword: Investment Strategy

- Investing in semiconductor, solar, and secondary battery related stocks can be a lucrative opportunity for savvy investors.

- With the increasing demand for technology and renewable energy sources, these sectors are expected to experience significant growth.

- Companies involved in the production of semiconductors, solar panels, and secondary batteries are poised to benefit from these trends.

- It is crucial for investors to conduct thorough research and analysis before making any investment decisions in these sectors.

- Diversifying a portfolio to include stocks from these industries can help mitigate risks and maximize returns in the long run.

- Investment Strategy for Semiconductor, Solar, and Secondary Battery Related Stocks

- Semiconductor Industry: Continued growth in demand for chips due to technological advancements.

- Solar Energy Sector: Increasing focus on renewable energy sources driving investment opportunities.

- Secondary Battery Market: Growth in electric vehicles contributing to demand for batteries.

Future Growth Potential in Semiconductor, Solar, and Secondary Battery Markets

The future looks bright for the semiconductor, solar, and secondary battery markets. These industries are expected to experience significant growth in the coming years, driven by advancements in technology and increasing demand for renewable energy sources.

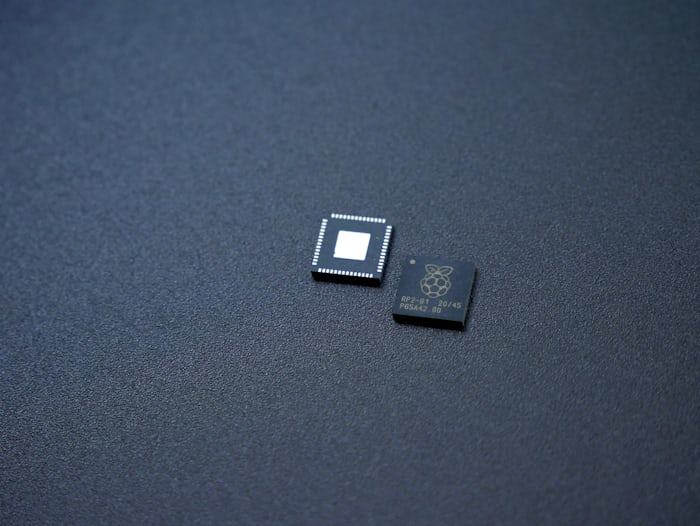

Semiconductor Market:

– The semiconductor market is poised for growth with the rise of emerging technologies such as 5G, IoT, AI, and autonomous vehicles.

– Demand for high-performance computing and data storage solutions is driving the market forward.

– Innovations in materials and manufacturing processes are leading to more efficient and powerful semiconductor devices.

Solar Market:

– The solar market is experiencing rapid expansion as governments and businesses invest in clean energy solutions.

– Falling costs of solar panels and increasing efficiency are making solar power more accessible and cost-effective.

– Growing environmental concerns and the push for sustainability are driving the adoption of solar energy worldwide.

Secondary Battery Market:

– The secondary battery market is booming with the growing popularity of electric vehicles and energy storage systems.

– Advancements in battery technology, such as lithium-ion batteries, are improving performance and driving market growth.

– Demand for portable electronic devices and grid-level energy storage solutions is also contributing to the markets expansion.

In conclusion, the semiconductor, solar, and secondary battery markets hold immense potential for future growth. As technologies continue to evolve and environmental awareness increases, these industries are expected to play a crucial role in shaping the future of energy and technology.The future growth potential of semiconductors, solar energy, and secondary battery markets is significant. Semiconductors have a key role in various industries, with emerging technologies like AI and IoT driving demand. The solar energy market is growing rapidly as renewable energy sources become more popular. The secondary battery market is also expanding due to the increasing adoption of electric vehicles and energy storage systems.

Summary:

- Semiconductors play a crucial role in various industries, with AI and IoT driving demand.

- The solar energy market is rapidly growing in response to the increasing popularity of renewable energy sources.

- The secondary battery market is expanding due to the rise in electric vehicles and energy storage systems.

New Opportunities in Semiconductor and Energy Markets

The semiconductor and energy markets are experiencing a wave of new opportunities. With advancements in technology and a growing focus on sustainability, companies are finding innovative ways to address the increasing demand for efficient solutions. In the semiconductor sector, the development of smaller, faster, and more energy-efficient chips is driving growth and opening up new possibilities for industries such as automotive, healthcare, and telecommunications. At the same time, the energy market is witnessing a shift towards renewable sources, leading to increased investments in solar, wind, and battery storage technologies. These developments present exciting prospects for companies looking to capitalize on the evolving landscape of the semiconductor and energy markets.Key opportunities in the semiconductor and energy markets

In the rapidly evolving landscape of the semiconductor and energy industries, there are several key opportunities emerging:

1. Increased demand for advanced semiconductors: As technologies such as 5G, IoT, AI, and autonomous vehicles continue to advance, the demand for advanced semiconductors is on the rise. Companies that can innovate and produce cutting-edge semiconductor technology stand to benefit greatly from this trend.

2. Rise of renewable energy sources: With a growing emphasis on sustainability and reducing carbon footprints, the energy market is shifting towards renewable energy sources such as solar and wind power. This provides opportunities for companies involved in renewable energy technologies to expand their offerings and capture market share.

3. Integration of semiconductor technology in energy: The convergence of semiconductor technology and energy systems is creating new opportunities for smart grid solutions, energy storage systems, and energy efficiency improvements. Companies that can leverage semiconductor technology to enhance energy systems are well positioned to lead in this space.

Overall, the semiconductor and energy markets present exciting opportunities for companies that are able to innovate, adapt, and capitalize on the emerging trends in these industries.

이 포스팅은 쿠팡파트너스 활동의 일환으로, 이에 따른 일정액의 수수료를 제공받습니다.